At the risk of sounding like a broken record, I’m going to say it again:

It’s not 2008 and the doom-and-gloomers are on the wrong side of the trade.

While the bears continue to insist that the glass is half full, about to shatter into a million pieces…

The truth is — four years into this debacle — things are actually getting better, not worse.

Believe or not, the economy is finally starting to turn. And last week’s 3Q GDP report only backs up my bullish case that the bears are wrong about the double-dip recession.

According to the Commerce Department, economic growth actually increased at the fastest pace in a year as consumers and businesses set aside their fears about the recovery and stepped up their spending.

For the quarter, fears of a double dip were cast aside as U.S. gross domestic product expanded at a 2.5% annual rate in the third quarter, accelerating from the 1.3% pace set in the April-June quarter.

What’s more, consumer spending over that period was the strongest since the fourth quarter of 2010, and business investment spending marked the fastest uptick in more than a year.

That’s bullish, not bearish.

Expansion Instead of Recovery

The long story short here is pretty simple: We are experiencing a moderate growth expansion — not some bearish apocalypse that is going to crash the DOW in the blink of an eye.

Notice I said expansion, not recovery.

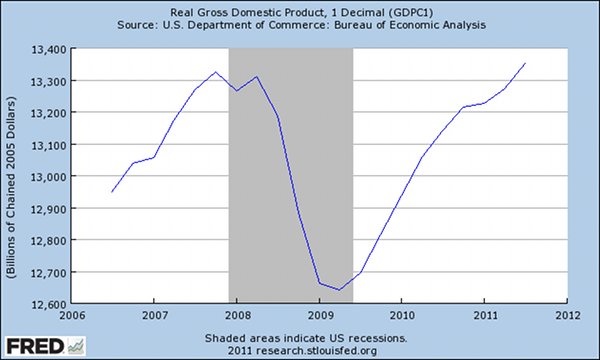

That’s because real GDP has now moved above its previous peak, going all the way back to Q4 2007. Take a look:

So after almost two years of recession followed by another two years of slow recovery, the U.S. economy has finally entered an expansion phase again.

Granted, it’s not robust. But it’s not the end of the world — not by a long shot.

What’s more, it’s just getting started…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

The Markets Turn Green

The markets are now green and comfortably above the bottom reached on October 4th when the DOW successfully tested the 10,600 level for the third time.

Almost four weeks later, the markets are now up over 14%.

The move has been so strong that this current rally is the biggest monthly advance since 1974. A similar 20% monthly move in the Dow Jones Transportation Average was the biggest jump since 1939.

That combination has helped to push the DOW above its 200-week moving average, which is bullish — especially now that we are headed into what has historically been a strong seasonal pattern.

One reason for this is earnings, which have been positive for the most part.

Now that more than half of the companies in the S&P 500 have released their quarterly results, a full 75% of them have beaten analysts’ estimates, according to data compiled by Bloomberg.

More importantly, net income for the group grew on average by 16% on an 11% increase in sales.

That’s a positive that will set up the markets for a nice run into the end of the year, now that the prospect of a double-dip recession has been taken off the board.

Profits Are Soaring

Corporate profits are at an all-time high.

In fact, as you can see from the chart, after-tax corporate profits are actually well above the previous peak going back to 2008:

That may be one of the reasons insiders aggressively began buying their own shares in August when the markets dropped 18% off the highs…

They knew a good bargain when they saw one.

In all, according to InsiderScore, a total of 919 insiders bought their own stock during the first 10 days of August as the slumping markets fell across the boards.

By comparison, that spending spree was second only to the March 2009 downturn, when massive insider buying effectively marked bear market lows. Over that ten-day period, 1,390 company executives stepped in to scoop up shares, ending the market crash.

Now, are insiders going to be right a second time?

Only time will tell…

Bullish Insider Buys

What we do know is that when insiders buy en masse, it is bullish. After all, they have a long history of being more right than wrong when it comes to the market’s direction.

In fact, big buys by insiders have correctly called 12 of 14 market bottoms since 2004.

“Insiders were so dead-on, it was scary,” says Ben Silverman, director of research at InsiderScore.

Of course, insiders haven’t been the only ones buying stocks…

To get complete articles and information, join our newsletter for FREE!

Plus receive our new free report, “How to Make Your Fortune in Stocks”.

Wealth Daily Members Receive:

Daily commentary and advice from financial market experts.

Access to some of the best gold, silver, and option stock picks around.

Foresight designed to help you stay on top of the market.

Your bargain-hunting analyst,

Steve Christ

Editor, Wealth Daily